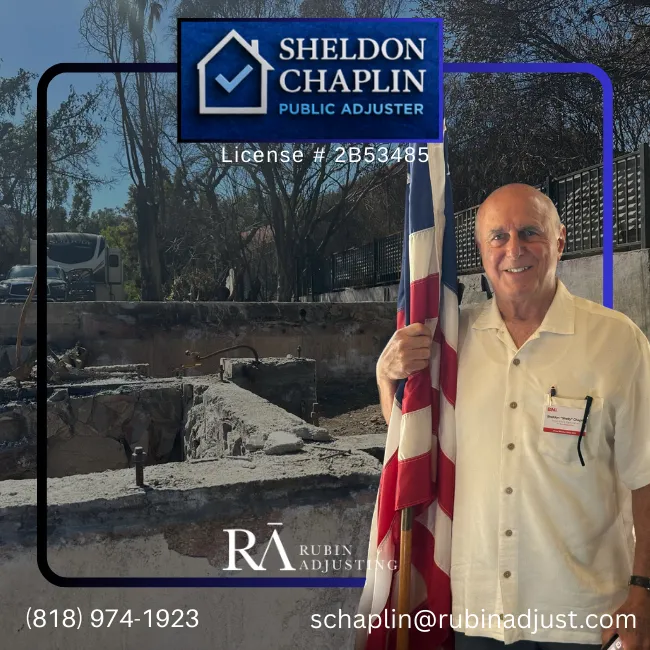

Pacific Palisades Rebuilding: How Public Adjusters Like Sheldon Chaplin Support Recovery

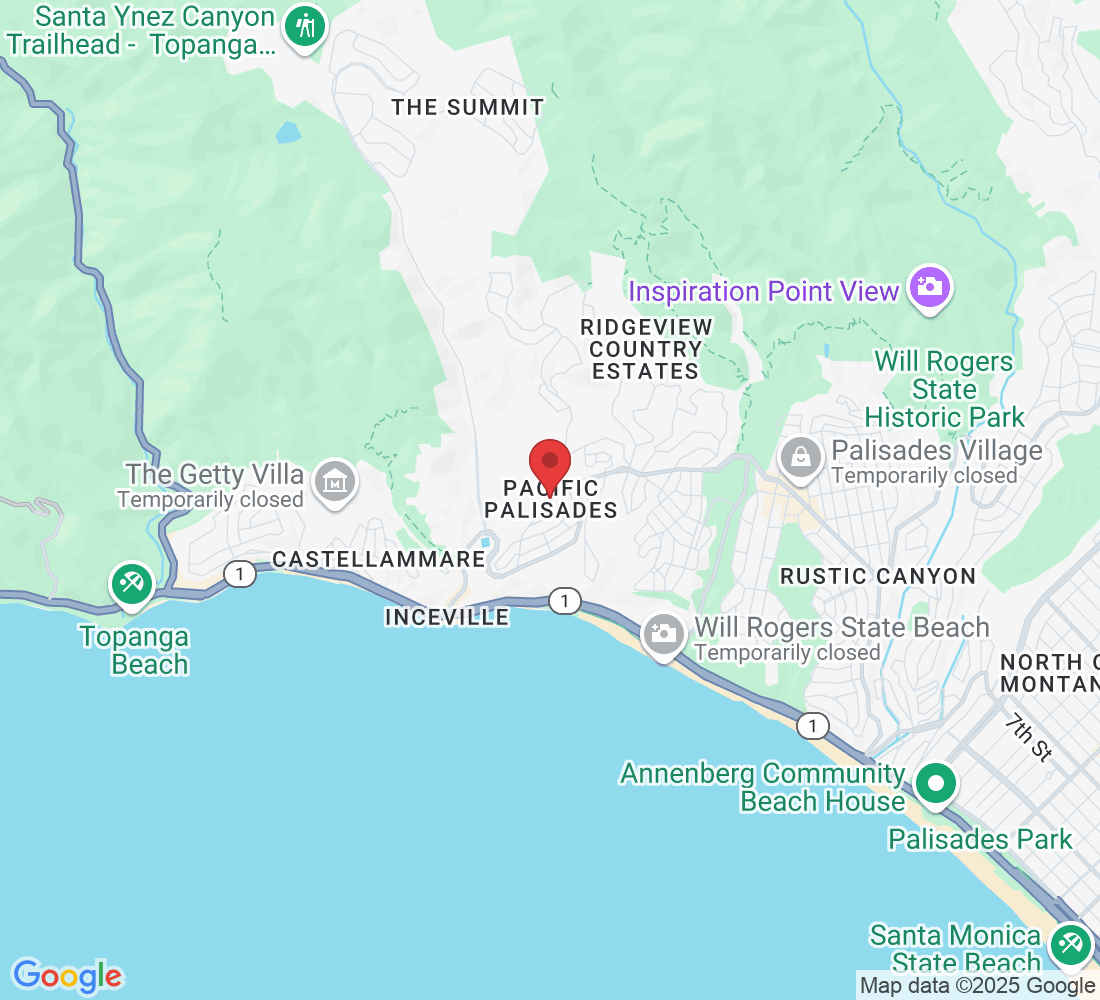

Overview of Pacific Palisades

Pacific Palisades, an upscale coastal neighborhood in Los Angeles, is known for its scenic beauty, luxury real estate, and strong community spirit. Home to approximately 28,000 residents, the area is perched between the Pacific Ocean and the Santa Monica Mountains. However, in recent years, Pacific Palisades has faced significant challenges due to destructive wildfires, leading to substantial property damage and a prolonged rebuilding phase.

The Rebuilding Effort and the Role of Public Adjusters

Wildfires have left a lasting mark on the Pacific Palisades landscape, displacing families and destroying high-value homes. In the wake of such disasters, the process of filing insurance claims and securing fair settlements can be overwhelming. This is where experienced public adjusters like Sheldon Chaplin of Rubin Adjusting become indispensable.

As a dedicated advocate for policyholders, Sheldon Chaplin works directly with homeowners to evaluate damages, interpret complex insurance policies, and negotiate maximum settlements with insurers. Rubin Adjusting offers a personalized approach during these trying times, helping clients restore not just property, but peace of mind.

- Thorough property damage assessments

- Expert navigation of policy terms and conditions

- Direct communication and negotiation with insurance carriers

- Timely documentation and claim submission

- Support throughout the rebuilding and restoration process

This professional guidance is crucial, particularly in communities like Pacific Palisades where home values are high and claims can be complex. With Sheldon Chaplin’s expertise, residents can focus on rebuilding while knowing their interests are being protected.

Practical Recovery Support: Logistics and Costs

Rebuilding in Pacific Palisades involves unique logistical challenges, from obtaining permits to navigating reconstruction timelines. Insurance claims play a critical role in funding these efforts. Public adjusters not only help secure funds but also ensure policyholders are not underpaid or delayed by insurance bureaucracy.

While the area remains one of the safest and most desirable in Los Angeles, the cost of living and rebuilding is high. Expert claim management can significantly ease financial strain and prevent delays in restoration projects.

Community Resilience and Lifestyle

Despite the setbacks, Pacific Palisades remains a vibrant and close-knit community. Residents have come together to support recovery, promote fire safety, and build stronger, more resilient homes. From local fundraisers to neighborhood volunteer efforts, the rebuilding has highlighted the spirit of togetherness and determination that defines this coastal enclave.

Public adjusters like Sheldon Chaplin contribute directly to this resilience, empowering homeowners with clarity and confidence in their insurance outcomes.

Why Sheldon Chaplin and Rubin Adjusting Stand Out

With years of experience handling complex claims across Southern California, Sheldon Chaplin is recognized for his integrity, transparency, and results-driven approach. Rubin Adjusting specializes in helping clients through emotional and financial recovery after disaster strikes, offering:

- In-depth policy reviews

- Documentation of both visible and hidden damages

- Collaboration with contractors and legal advisors

- Continued support until claim resolution

This hands-on service model is exactly what Pacific Palisades homeowners need to navigate post-wildfire recovery and future-proof their assets.

Comparison of Local Services During Recovery

| Service | Recovery Role | Specialization |

|---|---|---|

| Rubin Adjusting (Public Adjuster) | Claims advocacy & settlement negotiation | Fire damage, luxury property claims |

| Local Contractors | Property reconstruction | Home rebuilding & safety retrofitting |

| Legal Consultants | Policy disputes & legal filings | Insurance law & appeals |

To learn more about fire recovery resources or starting a claim, visit the California Department of Insurance or FEMA. You can also explore local updates on the City of Los Angeles website.