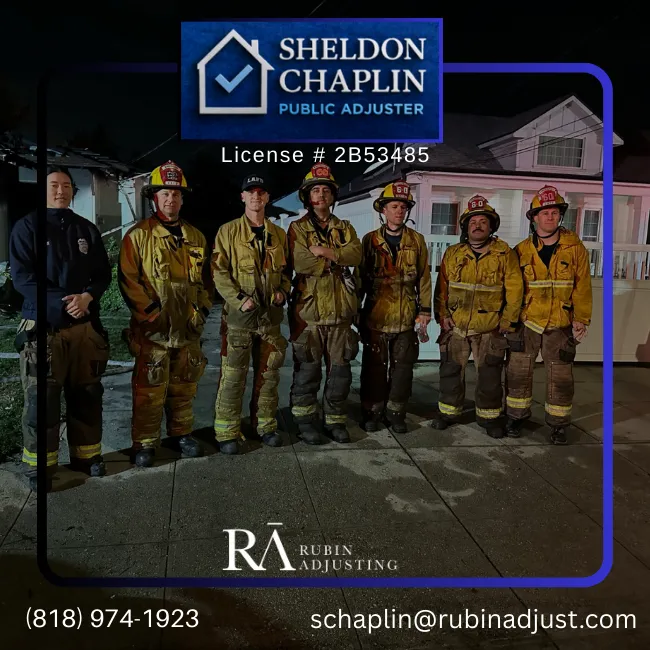

Public Adjusting

Trusted Public Insurance Adjusters in Southern California

Experts in Fire, Water, Wind, Earthquake, and Property Damage Claims

Need help with an insurance claim after unexpected property damage? From fire and water to earthquake and storm-related losses, Southern California’s top public adjusters are here to protect your interests. Browse our directory to find experienced professionals who advocate for homeowners and business owners—ensuring you get the full compensation you deserve. Start your claim process with confidence. Find a trusted adjuster near you today.

El Segundo

Encino

Granada Hills

Hawthorne

Westmont

Westwood

West Hollywood

Woodland Hills

The Challenges of Property Damage Insurance Claims

Why You Need a Public Adjuster

Property damage can strike when you least expect it—whether from fire, water, wind, storms, or even earthquakes. But the destruction of your home or business is only the beginning of a long road to recovery. One of the biggest challenges that policyholders face after a disaster is navigating the complex and often frustrating process of filing an insurance claim.

That’s where public adjusters come in.

The Hidden Complexity Behind Insurance Claims

Insurance is supposed to offer peace of mind. You pay your premiums year after year so that if the unthinkable happens, you’re protected. But when disaster strikes, many policyholders discover just how complex—and adversarial—the claims process can become.

Common Property Damage Scenarios:

- Fire and Smoke Damage

- Water and Flooding

- Mold and Mildew

- Wind, Storm, or Hail Damage

- Earthquake or Ground Shifting

- Theft or Vandalism

- Business Interruption

Challenge 1: Vague or Confusing Policy Language

Insurance policies are often packed with legal jargon, fine print, exclusions, and conditions. Most property owners aren’t familiar with terms like “actual cash value,” “replacement cost,” or “period of restoration.”

This confusion leads to misinterpretation, and in many cases, underpaid or denied claims. A public adjuster helps decode the policy and ensures all eligible coverage is leveraged.

Challenge 2: Documentation and Proof of Loss

Insurance companies require thorough documentation of the damage—including detailed inventories, estimates, photos, and sometimes engineering reports. Public adjusters step in to:

- Inspect the damage in detail

- Document every loss with precision

- Compile repair cost estimates

- File the proof of loss to insurer standards

Challenge 3: Disputes Over Claim Value

One of the most common frustrations is discovering that the insurance company’s offer doesn’t cover your repair costs. A licensed public adjuster negotiates on your behalf to ensure your payout reflects the real cost of restoration.

Challenge 4: Time Delays and Stress

Insurance adjusters may manage hundreds of cases. This results in delays and incomplete evaluations. Public adjusters handle follow-ups and communication so you can focus on recovery.

Challenge 5: Denied or Underpaid Claims

Insurance companies may deny a claim due to exclusions, late filing, or disputes over cause. Public adjusters can reopen, appeal, and dispute these outcomes to improve your final result.

What is a Public Adjuster—and How Do They Help?

A public adjuster is a licensed professional who represents the policyholder (not the insurer). They:

- Interpret your policy

- Assess and document all damage

- Negotiate with the insurance company

- Ensure compliance with conditions and deadlines

They work on a contingency fee—only getting paid if you do.

Benefits of Hiring a Public Adjuster

| Benefit | What It Means for You |

|---|---|

| Higher Settlements | Get paid more for your damage claim |

| Faster Resolutions | Your claim moves forward without delay |

| Expert Representation | A professional advocates for your best interest |

| Reduced Stress | They handle the paperwork and follow-ups |

| Professional Documentation | Your claim is built with precision |

| Policy Guidance | Understand your rights and coverage |

When Should You Contact a Public Adjuster?

It’s best to contact one as soon as damage occurs. But they can also help if:

- You’re overwhelmed by the process

- You received a low settlement offer

- Your claim was denied

- You have business interruption losses

- You own high-value or complex properties

Final Thoughts

Insurance claims for property damage are rarely straightforward. Between policy complexity, documentation, and delays, many owners feel lost and underpaid. Working with a public adjuster ensures you have an expert by your side to fight for a fair, timely, and stress-free settlement.

If you've suffered property damage, don’t go it alone—consult a trusted public adjuster and take control of your claim.