Life in the City of Angels

Los Angeles is a sprawling metropolis that blends cultural richness, entertainment, and economic power into one of the most iconic urban experiences in the world. From beachside strolls in Santa Monica to late-night tacos in East LA, the city serves up diversity and excitement around every corner. With world-class schools, booming industries, and nearly every climate microzone imaginable, Los Angeles is a dream for many.

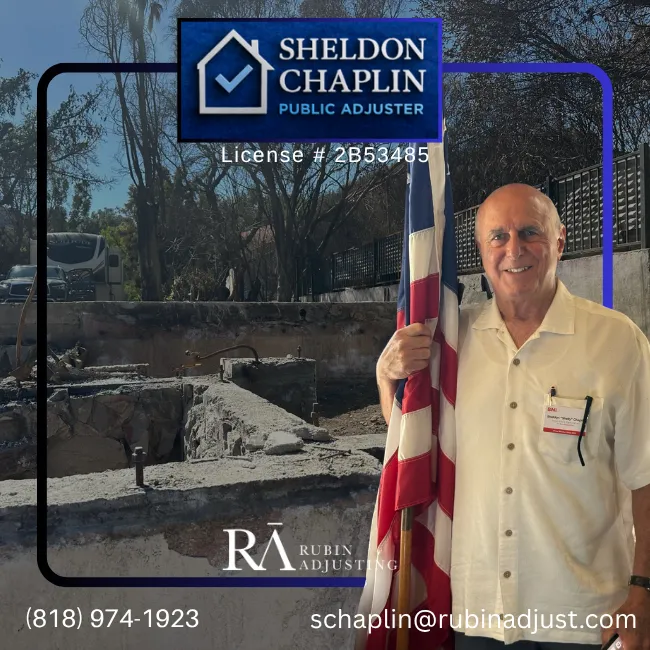

But living in such a vast, high-value urban environment also comes with its risks—fires, floods, earthquakes, and more. That's where the role of a public insurance adjuster becomes indispensable. These professionals act on behalf of property owners to ensure fair and timely insurance claim settlements in times of crisis.

Navigating the Neighborhoods

Each part of Los Angeles has its own identity. Westside communities like Brentwood and Pacific Palisades offer luxury and coastline. The Eastside is rich with culture and historic charm, while Downtown LA is undergoing a modern renaissance. In every neighborhood, property needs and insurance challenges vary.

From water leaks in high-rise apartments to wildfire damage in hillside homes, local public insurance adjusters help Angelenos get the most from their policies. They understand regional nuances and can navigate complex claims for both residential and commercial property owners.

| Neighborhood | Typical Property | Common Claims |

|---|---|---|

| Hollywood Hills | Luxury hillside homes | Wildfire and smoke damage |

| Downtown LA | High-rise apartments and commercial units | Water damage and vandalism claims |

| Venice | Beachfront properties | Flooding and storm-related damage |

The Importance of Public Insurance Adjusters

Insurance policies can be dense, and claim processes are often overwhelming—especially in times of crisis. Public insurance adjusters simplify this complexity. Unlike adjusters hired by insurance companies, public adjusters work solely for you, the policyholder. They assess damages accurately, file paperwork, negotiate with insurers, and ensure you receive the full payout you deserve.

This is especially critical in Los Angeles, where real estate is expensive and policy coverage gaps can be financially devastating. Public adjusters serve as a buffer between chaos and clarity.

Urban Resilience and Local Advocacy

Los Angeles is no stranger to emergencies—earthquakes, brushfires, and torrential rain can upend life in an instant. As the city invests more in climate adaptation and emergency response, public adjusters are also stepping up their game. Many firms now offer proactive services like risk audits, coverage reviews, and disaster readiness planning.

They also support local recovery initiatives, working alongside homeowners’ associations, neighborhood councils, and emergency planners. Their mission aligns with LA’s broader goals: to protect, recover, and rebuild efficiently.

Why Los Angeles Remains a Top Choice

Despite the risks, Los Angeles remains one of the most desirable places to live. Its job market, entertainment industry, diversity, and endless lifestyle options keep it magnetic. Residents know that by combining personal preparedness with professional support—like that from public insurance adjusters—they can weather any storm, literally and figuratively.

Having an advocate when you need it most not only improves outcomes—it adds a layer of peace of mind to owning or renting in a city that never sleeps.

- Expert representation during insurance disputes

- Comprehensive claim documentation and valuation

- Assistance with post-disaster recovery planning

- Policy reviews for hidden vulnerabilities