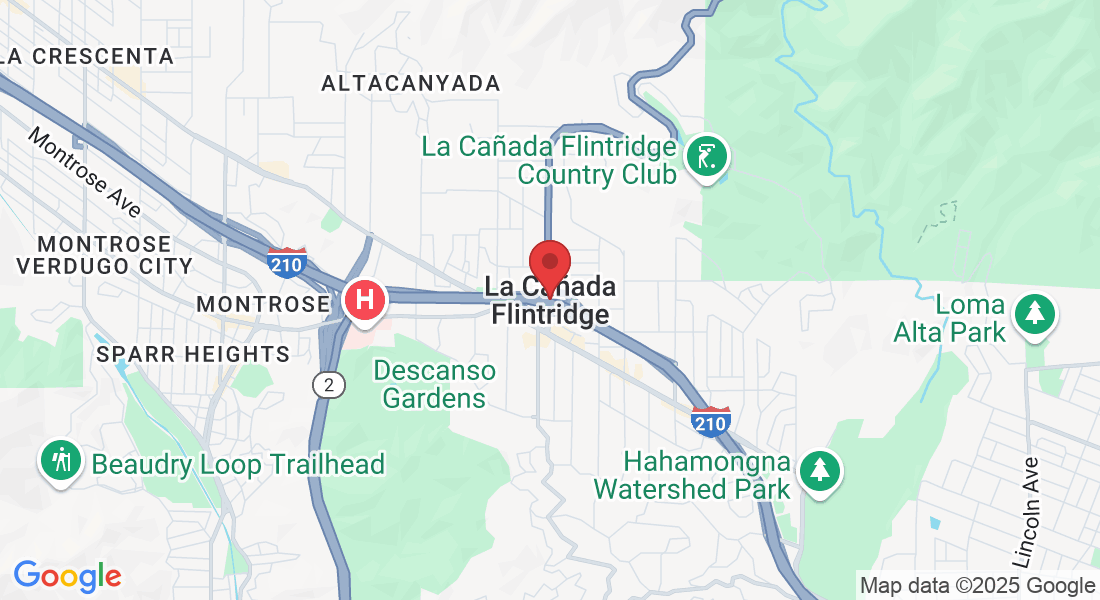

Nestled at the foothills of the San Gabriel Mountains, La Cañada Flintridge is one of Los Angeles County’s most serene residential gems. Known for its lush tree-lined streets, strong sense of community, and highly ranked schools, the city offers a peaceful escape from the bustle of downtown Los Angeles, while still being conveniently close to urban conveniences. With a population of just over 20,000, it’s a tight-knit, family-oriented area that balances suburban tranquility with cultural richness. Life in La Cañada Flintridge is not just about beautiful homes and mountain views—it’s about a lifestyle that emphasizes security, preparedness, and community support, especially when unexpected events like wildfires or storms strike. This is where professional services, such as public adjusters, play a crucial role in ensuring residents feel secure and supported.

A Peaceful Residential Haven

La Cañada Flintridge consistently attracts families seeking safety, quiet streets, and strong educational opportunities. The La Cañada Unified School District is one of the highest-rated districts in California, making it a magnet for families prioritizing academics. Neighborhoods are filled with single-family homes, many boasting expansive lots, mature trees, and views of the San Gabriels or the Angeles National Forest. For those who appreciate the outdoors, there’s easy access to trails, parks, and the iconic Descanso Gardens—a botanical retreat that reflects the area’s slower pace of life and appreciation for nature.

Because of its hillside geography and proximity to wildland areas, residents also take property protection seriously. Wildfires, wind damage, and occasional flooding are realities that make homeowners especially proactive in understanding insurance coverage. This is where local public adjusters become indispensable, helping homeowners navigate complex insurance claims and ensuring they receive fair settlements to rebuild and restore their homes when natural challenges arise.

Community and Local Lifestyle

The social fabric of La Cañada Flintridge revolves around community events, local businesses, and outdoor living. The weekly farmers’ markets, summer concerts at Memorial Park, and holiday parades help foster a small-town charm that stands out in Southern California. Shopping and dining options are largely local, with boutique shops and eateries giving the town a distinct identity apart from its larger neighboring cities like Glendale and Pasadena.

Residents enjoy a lifestyle that blends suburban comfort with easy commuting to the broader Los Angeles region. Yet, living near mountainous terrain does come with responsibilities—residents understand the value of preparation for property-related issues. Public adjusters often partner with homeowners during insurance assessments after seasonal storms, helping maintain the area’s reputation for resilience and seamless recovery when challenges arise. Their expertise allows residents to focus on their families and daily routines while ensuring their homes and investments remain protected.

Why Public Adjusters Matter Here

Homeownership in La Cañada Flintridge can be both a dream and a challenge. While the serene surroundings and upscale neighborhoods make it desirable, property owners face higher stakes when it comes to damage or loss due to the area’s location near natural risk zones. Public adjusters serve as advocates for property owners, reviewing policies, assessing damages, and negotiating with insurance companies to maximize settlements. Their work ensures that families aren’t left navigating complex insurance paperwork during already stressful times.

Some of the primary ways public adjusters benefit La Cañada Flintridge residents include:

- Guiding homeowners through wildfire and wind damage claims to ensure accurate reimbursement.

- Helping businesses and families recover quickly after unexpected property damage disrupts daily life.

- Acting as a liaison with insurance providers to save residents time and reduce stress.

- Educating property owners on proactive policy reviews to avoid gaps in coverage.

Exploring Neighborhoods and Property Needs

Each neighborhood in La Cañada Flintridge offers its own charm and considerations. Whether you live near Oak Grove, Palm Crest, or closer to the Angeles Crest Highway, understanding the nuances of your property is key to maintaining long-term value. In some hillside areas, for example, homeowners face greater risks of mudslides or fire exposure, while central neighborhoods enjoy flatter terrain and easier access to schools and businesses.

For newcomers evaluating where to live, here’s a quick comparison of neighborhoods and the common property considerations they face:

| Neighborhood | Lifestyle Highlights | Property Considerations |

|---|---|---|

| Oak Grove | Near trails and open space, popular for outdoor enthusiasts | Higher wildfire risk; insurance claims may require expert help |

| Palm Crest | Family-friendly with easy school access | Occasional wind damage; roof assessments are common |

| Flintridge Flats | Close to shops and community events | Lower natural risk, but aging homes may need insurance-backed repairs |

Balancing Comfort and Preparedness

Living in La Cañada Flintridge offers a rare mix of comfort, beauty, and community spirit, but part of its appeal lies in being prepared for the unexpected. Families and businesses here value the peace of mind that comes with knowing experts, like public adjusters, are available to help them navigate the complexities of insurance and property protection. This proactive mindset not only protects financial well-being but also supports the area’s ability to rebound quickly after challenges, preserving the lifestyle that makes this community so desirable.

Whether you’re relocating to La Cañada Flintridge or already call it home, understanding the city’s residential character—and the importance of services that help protect that investment—will help you thrive in this scenic foothill city.