Discovering Brentwood's Residential Appeal

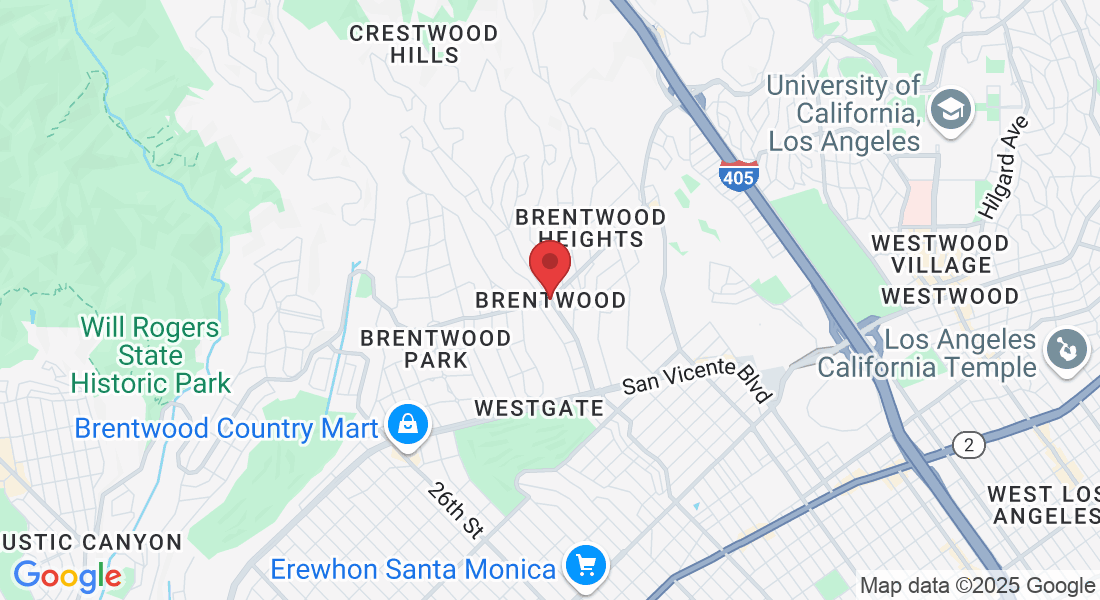

Nestled in the western region of Los Angeles, Brentwood stands out as a picturesque and affluent neighborhood known for its tree-lined streets, upscale homes, and relaxed suburban atmosphere. This community offers a perfect blend of luxury and comfort, making it a prime location for families, professionals, and retirees alike. From stylish boutiques to farmer’s markets, Brentwood reflects a serene pace of life without sacrificing access to the dynamic culture of LA.

What distinguishes Brentwood from other Los Angeles neighborhoods is its commitment to maintaining a balance between urban convenience and residential tranquility. Homeowners take pride in their properties, and with the high value placed on real estate in the area, services like public adjusters play a vital role. When unexpected damage from fire, weather, or water intrusion occurs, Brentwood residents often turn to local public adjusters to ensure their insurance claims are properly handled—preserving both property value and peace of mind.

Community and Lifestyle Highlights

Brentwood boasts an array of lifestyle benefits. The neighborhood is home to several parks, including the popular Brentwood Country Mart, a hub for local dining and shopping. The Getty Center, just a short drive away, adds a touch of world-class culture to the area. Educational institutions like Brentwood School and Kenter Canyon Elementary make it attractive for families prioritizing academics.

Residents here enjoy walkability and safety, two qualities that contribute to a strong community fabric. Brentwood also values preparedness and resilience. The integration of public adjusters into the community ecosystem offers residents peace of mind when dealing with property claims—especially important in a region that can experience earthquakes and wildfires. Public adjusters work closely with families and property owners to ensure settlements are accurate and timely, helping residents recover and rebuild efficiently.

Real Estate and Neighborhood Breakdown

Brentwood's real estate ranges from elegant single-family homes to modern condominiums. The area is divided into distinct residential zones, each offering its own flavor of charm and luxury. Below is a brief comparison of some key Brentwood neighborhoods:

| Neighborhood | Key Features | Average Home Price |

|---|---|---|

| Brentwood Park | Large estates, celebrity residents | $8M+ |

| Crestwood Hills | Architectural homes, hillside views | $3M - $5M |

| Brentwood Glen | Family-friendly, quiet streets | $2M - $4M |

The Role of Public Adjusters in Brentwood

In a city where property values soar and homeowners invest heavily in their homes, managing insurance claims after damage is not just a technical process—it’s a strategic necessity. Public adjusters in Brentwood serve as advocates for property owners, negotiating with insurance companies to ensure fair compensation.

These professionals are especially critical after natural events such as windstorms, wildfires, or unexpected plumbing issues. Their expertise helps homeowners avoid underpayment or denial of claims, ultimately ensuring that homes are restored to their original condition without undue financial burden. Public adjusters also save valuable time for Brentwood’s busy residents, many of whom prefer expert representation to navigating complex claim processes alone.

Making the Most of Brentwood Living

Living in Brentwood offers more than just elegant homes—it’s about enjoying a community that values quality, resilience, and thoughtful living. Residents benefit from a wide array of services designed to support a seamless lifestyle. Public adjusters are one such service, providing an essential link between residents and the protection of their homes and investments.

Whether you’re strolling through the scenic streets, enjoying organic cuisine at a local cafe, or ensuring your property is fully protected, Brentwood allows its residents to live with confidence and ease.

- Safe, walkable neighborhoods with family appeal

- Access to elite schools and cultural landmarks

- Supportive local services, including expert public adjusters

- Strong sense of community and proactive disaster readiness