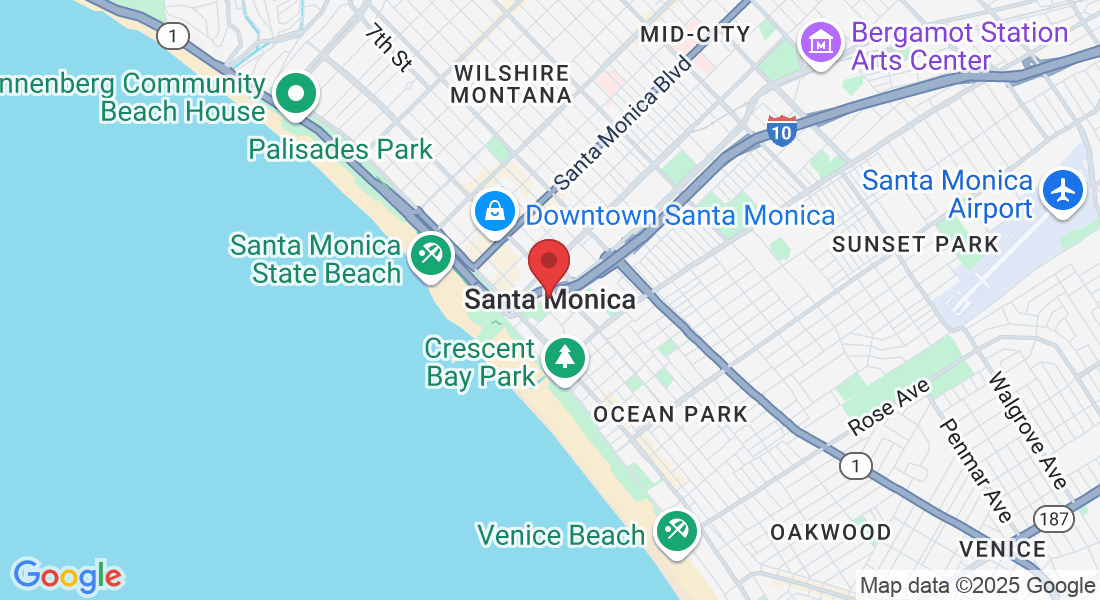

Santa Monica, with its iconic pier, stunning beaches, and vibrant cultural scene, is one of Southern California’s most desirable coastal cities. Home to a dynamic mix of professionals, families, and creatives, Santa Monica offers an urban-meets-beach lifestyle unlike any other. With a population of around 90,000 and easy access to Los Angeles, the city combines a bustling economy, world-class dining, and oceanfront living with a community-driven vibe. While life here feels like an endless vacation, coastal residents also deal with the realities of oceanfront living, including salt air wear, storm-related property damage, and dense urban development. For homeowners and businesses alike, having the guidance of public adjusters can make a significant difference when navigating insurance policies and claims in a city where property values and risks run high.

A City Where the Ocean Shapes Life

The Pacific Ocean is the heartbeat of Santa Monica. From surfing at the beach to biking along the Marvin Braude Bike Trail, locals and visitors alike thrive in the city’s outdoor culture. The year-round Mediterranean climate allows for endless recreational opportunities, from early morning yoga on the sand to weekend paddleboarding. Neighborhoods near Ocean Avenue or Montana Avenue offer upscale residences with views of the water, while inland areas like Sunset Park and Pico District provide a more laid-back, residential feel.

However, the proximity to the ocean also brings unique challenges. Homes and buildings face accelerated wear from salty air, while storms and high tides can lead to occasional property damage. Public adjusters help homeowners and businesses by ensuring insurance policies properly account for these coastal risks, streamlining claims when damages occur and securing settlements to protect valuable investments along the shoreline.

The Local Lifestyle and Economy

Santa Monica is more than just a beach town—it’s a thriving urban hub. The city hosts a growing tech sector often referred to as “Silicon Beach,” a world-renowned dining and retail scene on the Third Street Promenade, and a variety of cultural venues including the Broad Stage and Bergamot Station. Residents enjoy a work-play balance, with many able to bike or walk to local co-working spaces, boutiques, or the beach.

Community events like the weekly farmers’ markets, outdoor movie nights, and yoga festivals foster a vibrant, social lifestyle. Yet, the urban density also means property owners face challenges like water damage in multi-unit buildings, unexpected fires, or storm-related flooding. Public adjusters are often called upon to assist property managers and owners in ensuring claims are handled efficiently, so businesses and families can quickly return to enjoying the city’s thriving lifestyle without extended interruptions.

The Role of Public Adjusters in Santa Monica

With Santa Monica’s high property values and coastal risks, public adjusters play a crucial role in safeguarding residents’ financial interests. When property damage occurs—whether due to a burst pipe, roof leaks from a winter storm, or salt-related structural deterioration—insurance claims can become complex and time-consuming. Public adjusters advocate for property owners, reviewing policies, assessing damage, and negotiating fair settlements with insurance carriers, ensuring that residents and businesses receive the full benefits they’re entitled to.

Here are some of the key ways public adjusters support Santa Monica residents:

- Assisting with storm, wind, and water damage claims for beachfront properties.

- Helping multi-unit property owners and managers navigate complex insurance disputes.

- Saving residents time by managing insurance paperwork and negotiations.

- Conducting proactive reviews to identify gaps in coverage for coastal-specific risks.

Neighborhoods and Property Insights

Each part of Santa Monica has its own lifestyle perks and property considerations. From ocean-view condominiums to inland family homes, understanding local risks helps owners make informed decisions. Below is a comparison of several key neighborhoods and their most common property concerns:

| Neighborhood | Lifestyle Highlights | Property Considerations |

|---|---|---|

| Ocean Park | Beachfront living with artsy, eclectic vibes | Salt exposure and storm damage; frequent insurance claims |

| Montana Avenue | Upscale shopping and walkable streets | Older homes may need insurance-backed renovations |

| Sunset Park | Family-friendly with parks and good schools | Occasional water damage and wind-related roof issues |

Living Well and Staying Prepared

Santa Monica offers a world-class lifestyle, from its beach culture to its urban conveniences. Yet, property ownership here also means understanding the unique risks of coastal living and urban density. Public adjusters provide peace of mind for residents, helping them protect their investments, streamline claims, and recover quickly from unexpected events. By partnering with experts who understand the local landscape, homeowners and businesses can focus on enjoying all that Santa Monica has to offer, knowing they’re prepared for any challenge the environment may bring.

Whether you’re considering a move to Santa Monica or already soaking up the coastal breeze, understanding how to safeguard your home and property is key to thriving in this vibrant city by the sea.